How Keeping a Mileage Logbook Can Save You Money on Taxes

Many people aren’t aware of how much money they can save by keeping a mileage logbook. This can be especially true if you use your vehicle for business purposes.

The IRS takes business expense reimbursement seriously, and keeping accurate mileage logs for your company or yourself is a big deal. If you don’t, it may result in an audit or loss of years of deductions.

It’s a Good Record of Your Driving

A mileage logbook can help you comply with IRS regulations if you’re a business owner. This can save you time and money, allowing you to make accurate deductions and reimbursements for your expenses.

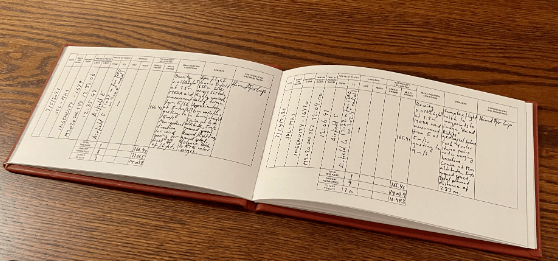

While it’s easy to get swept up in the rush of business travel, keeping track of all your miles is essential so you don’t miss out on legitimate tax deductions. You can do this by holding a regular logbook or using an Excel spreadsheet, PDF, or free mileage logbook app.

Besides being a helpful tax tool, mileage tracking can also help you save money on your fuel costs. This can be especially beneficial if you use an on-demand platform, as these services automatically track your on-trip mileage.

However, it’s a good idea also to record your mileage manually to ensure that your records are accurate and complete. This will help you avoid making mistakes that could harm your overall claim.

Moreover, keeping a mileage log can be an excellent way to improve your driving habits and reduce your fuel consumption and maintenance costs. This will save you money in the long run and can even help you improve your CSA (Compliance, Safety, Accountability) scores.

It’s a Good Record of Your Expenses

If you’re a freelancer or self-employed and must file taxes, keeping a mileage logbook can save you a lot of money. The CRA and IRS require you to keep a detailed record of all business-related driving to support your vehicle expense claims. You can use a simple pen and paper logbook or go digital with a mileage app on your smartphone.

The most important thing is ensuring your mileage logbook is as accurate and up-to-date as possible. The CRA wants to see every trip you take for work, and it’s not uncommon for people to forget details about their travels or leave gaps in their records.

As a result, it’s essential to choose a mileage-tracking app that offers a comprehensive suite of features to keep track of your expenses. The best apps will help you save a mileage logbook, classify business-related expenses and export IRS-ready reports.

You’ll need to start by recording your odometer reading at the beginning and end of each drive. This will allow you to determine the total mileage traveled during the year and then multiply that number by your standard mileage rate for your particular situation.

When you’re done, you can use this number to calculate your actual expenses or claim the tax deduction using the standard mileage rate method. Generally, the primary expenses method provides more savings for most people because it allows you to deduct a proportional amount of your existing car expenses.

It’s a Good Record of Your Income

A mileage log is a document that records the miles you travel for business purposes over a certain period. This allows you to claim a tax deduction or reimbursement for the costs you incur for traveling in your car.

There are many ways to keep a mileage log, including spreadsheets and apps. The key is to make sure that the records you keep are accurate. If the IRS finds that your log is inaccurate, the mileage you claim won’t be tax-deductible.

The IRS will look for many things to verify that you’re claiming your mileage correctly. One thing that will get their attention is post-dated entries in your mileage log. They’ll want to see how many miles you drive daily to verify your reasonable claims.

In addition to logging your miles, you’ll also want to record any expenses related to traveling for business. This can include gas, insurance, maintenance, etc. You should keep these records for at least three years after you file your taxes.

For most people, using the actual expense method of claiming their car costs will provide them with more tax savings than the standard mileage rate. However, this method will require tracking your vehicle expenses to take advantage of the maximum deduction possible. This can be a difficult task, so consider an app like Keeper that makes tracking your driving and car expenses easier.

It’s a Good Record of Your Taxes

Keeping accurate records is essential for claiming various tax deductions and credits. It can also help you prepare your tax return more quickly and accurately.

A mileage log can also help you substantiate your vehicle expenses and avoid an audit from the IRS. It can be as simple as a pen and paper or an app to track your miles.

The IRS allows freelancers, gig workers like Uber and Lyft rideshare drivers, and the self-employed to deduct their business miles in one of two ways: with a standard mileage rate or an actual expense method. If you use the standard mileage rate, you’ll need to keep a mileage logbook or an app like Keeper to record your business miles throughout the year.

If you use the actual expense method, you’ll need to substantiate your mileage expenses by tracking how much fuel you purchased and how many miles you drove. The IRS is very strict about excessive claims for car-related expenses, so if you claim too much in one year, it may cause a tax audit.

Mileage logs are also helpful in claiming the cost of fuel and car insurance, which can add up to significant savings over time. In addition, they can be an essential tool for determining your business mileage ratio, which is needed to substantiate the business mileage you claimed in your taxes.